This training program combines four of our Training & Certification Programs for the hardest to administer of the federally-mandated compliance laws:

- COBRA

- FMLA

- ADA

- Integrating FMLA, ADA, COBRA, and Workers Compensation

It is ideal for anyone in HR who is responsible for compliance with these distinctive laws. This includes not only HR professionals, but company owners and managers who need to be aware of the legal requirements under each of these laws.

How The Courses Work

Each course uses the same award-winning interface, giving you a quick and easy way to help you understand and comply with these laws and their respective and often interlocking compliance requirements. Each course includes:

- Numerous administrative tips

- Compliance suggestions

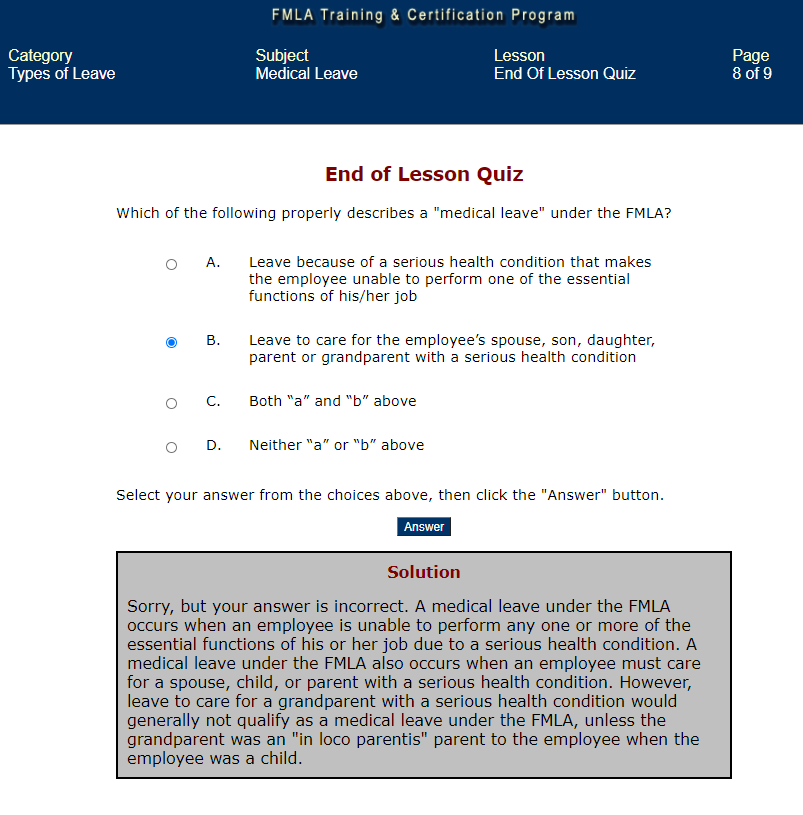

- Interactive quizzes (complete with answer rationales)

- FREE test for earning a "Certified Administrator" designation in each of these four areas

These courses sell individually for $799. Purchase this suite of courses now and not only save over $400 - but protect your organization against harmful and time-wasting lawsuits!

What You Will Learn From The Management Certification Suite

This program provides excellent guidance on administering FMLA, ADA, and COBRA laws, plus includes a separate course on how to integrate these laws (as any HR professional will tell you, the challenge for many HR professionals is in determining which law takes precedent and/or applies.

For instance, you'll learn about:

- Eligible participants for each law

- When FMLA, ADA, and/or PWFA apply

- Is it an ADA disability, PWFA limitation, or FMLA serious health condition?

- Leave and Accommodation Issues

- Return-To-Work options

- How to handle requests for medical information

- How to handle multiple coverage situations

- Tips for claims submittals

- Reporting and disclosure requirements

- Determining which law has precedence in certain situations

- Understanding when - and if - COBRA should be offered in relation to FMLA, ADA, and/or PWFA leaves

- How USERRA integrates with FMLA, ADA, COBRA, and Cafeteria Plans

Program Benefits

Besides the great training, here are some of the additional benefits:

- Award-winning, easy-to-use interface that includes numerous "Administrative Tips" and examples that highlight key learning areas

- Interactive Q&A with answer rationale provided to help ensure learning and check your progress along the way

- Procedural recommendations that provide key processes and procedures

- Access via the Internet allows you to study at your pace and access materials anytime, anywhere

- Special "Bookmark" feature that allows you to learn at your own pace and quickly return to training if you are interrupted

- Included exam to earn a "Certified COBRA Administrator" designation

- FREE updates when the laws change helps your organization to stay up-to-date with regulatory changes - and avoid costly compliance errors and lawsuits!

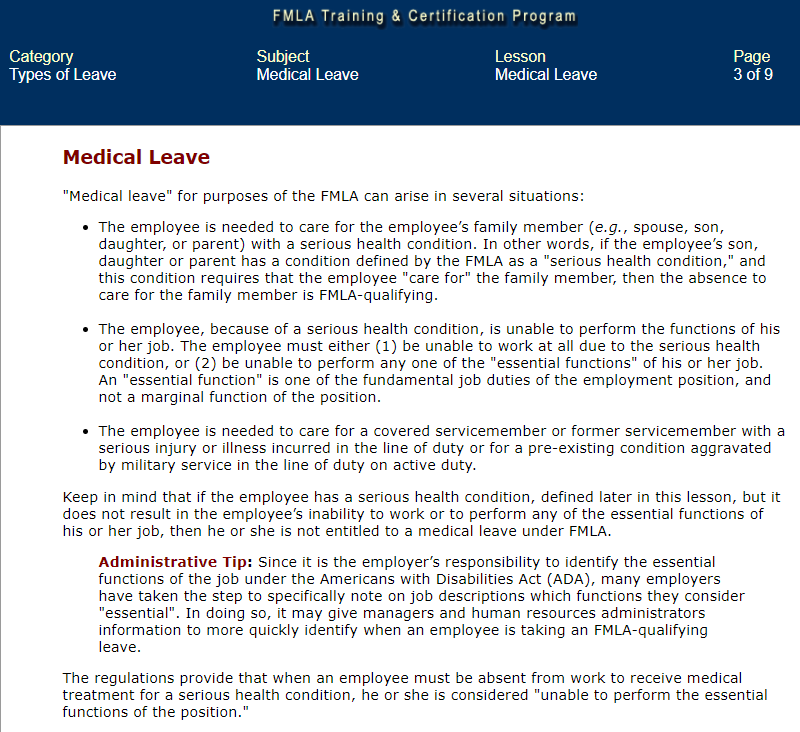

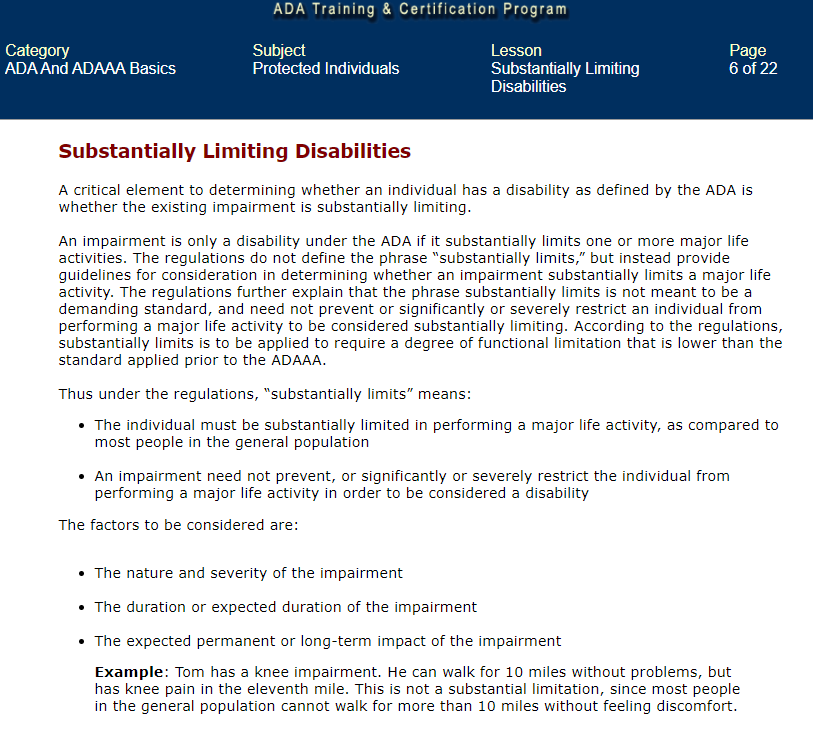

ExamplesAs mentioned above, the course contains numerous tips and examples, plus includes Interactive Q&A with answer rationale provided to help ensure learning and check your progress along the way. Below are some examples.

Bonus: HRCI and PDC Re-Certification Credit Hours

Bonus: HRCI and PDC Re-Certification Credit Hours

This suite of courses provides 32 hours of SHRM and HRCI re-certification credits!

For details on any of the courses, either click the course name below or call us at 770-410-1219.

Top FAQs

Cafeteria Plans allow employees to pay certain qualified medical expenses on a pre-tax basis.

The FLSA generally requires covered employers to pay nonexempt employees overtime pay of at least one and one-half times their regular rate. Employers also must keep detailed payroll records.

Prompt reporting, quick action, managing care, and a return-to-work planning.

Some of the work involved in developing a Compensation Plan includes analyzing and evaluating jobs, performing market surveys, writing job descriptions, and communicating and evaluating your plan.

Yes. Additionally, there are certain rules regarding what qualifies, status changes, use of funds, and more.

A Cafeteria Plan is an employer-sponsored benefit that complies with Section 125 of the Internal Revenue Code.

While the site does not provide maximum class size, course reviews (over 400) rate it highly (4.89 average), and student testimonials praise instructor knowledge, responsiveness, and real-life examples.

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector.

Leave management includes the processes and requirements of managing employee absences, such as vacation, holidays, sick leave, and parental leave.

Attending FMLA Training for Managers and HR Professionals can help you stay updated on the latest rules and regulations and handle leave management effectively. This makes in-person and online FMLA, ADA, and Leave Management training a practical investment for HR professionals.

Yes - completing the course grants 18 HRCI (for PHR/SPHR recertification) credits and 18 SHRM Professional

ERISA does not require any employer to establish a retirement plan. It only requires that those who establish plans must meet certain minimum standards.

Handling claims, medical certifications, return-to-work, terminations, and more.

There is no prerequisite. The course is designed for HR professionals at various levels who handle or will manage leave, accommodation, disability, and compliance issues.

Participants receive a 300-page workbook including sample forms, templates, case citations, and policies. You'll also get practice exercises, documentation toolkits, and interactive case studies. After completion, you get ongoing updates to course materials when laws change.

They definitely can be. For instance, though FMLA permits up to 12 weeks of leave, certain employees always seem to take a Friday or Monday off under leave laws, so employers can take advantage of FMLA, ADA, and Leave Management training courses so they can fight against abuse legally.

There are several: employees get beneficial tax treatment on certain expenses, while employers get to cost share health care premiums and save on reduced payroll tax expenses.

The schedule includes multiple U.S. cities and dates, plus video-conference versions. Because many venues are listed (e.g., Atlanta, Boston, Seattle, etc.), you can select the city and date you prefer.

Arguable, the most confusing aspect of Leave Management is understanding the benefits for each law - including knowing both state and federal law - for FMLA, ADA, and other laws, especially if the various laws conflict or overlap. This is why certified FMLA training courses are important.

More Infooss costs, loss cost multipliers, rates, experience modification factors, schedule credits, premium discounts, expense constant. Unravel the mystery and learn why some employers pay much more than others for the same coverage.

What you need to track, when you need to track it, and why

Compensation planning is the process of defining and implementing the strategies that will be used to attract, motivate, and retain talent to help an organization meet its operating objectives and employee needs.

Yes - organizations sending six or more participants may arrange private, on-site training (which can be significantly discounted).

It is a three-day, instructor-led, in-person (classroom) format. The content is delivered through lectures, case studies, interactive exercises, group discussion, and role-plays.

Yes. There are also notice and reporting requirements to have a qualified Cafeteria Plan.

Develop, maintain, and manage the organization's workers' comp program, including communicating with employees, managers, insurance carriers, medical providers, attorneys, and upper management, handling claims, the reporting requirements, medical-related issues, and fraud investigations.

Yes. Certain types of Compensation Plans do require a written plan document, plus have certain notice and reporting requirements.

A Compensation Plan consists of the salary, wages, commissions, benefits, and perqs paid to attract and retain employees.

Workers Comp is an insurance that provides certain wage and other benefits to people who are injured or become ill at work. Coverage and benefits are mandated by each individual state and can vary according to the state in question.

The program provides comprehensive training on compliance with the FMLA (Family and Medical Leave Act), ADA (Americans with Disabilities Act), and PWFA (Pregnant Workers Fairness Act). Topics include medical certifications, fitness-for-duty testing, return-to-work, reasonable accommodations, leave entitlement, overlapping laws (e.g. workers' compensation, state family/medical leave), job and benefits restoration, documentation strategies, and more.

Yes - the format includes Q&A, case study discussion, and time to address your real-world issues.

Cafeteria Plans offer tax savings on certain health insurance premiums for medical, dental, and vision coverage, plus certain costs for health and dependent care

This is ideal for HR professionals, leave administrators, managers, compliance officers, and legal or operations leaders who handle or oversee leave, accommodation, disability, or health-related workforce issues.

Insurance Agents also should understand his or her applicable state's workers' comp rules and requirements, responsibilities of the organization, proper procedures for claims handling and return-to-work, and how to investigate claims of fraud.

As laws and interpretations change (in FMLA, ADA, PWFA, etc.), HRTrainingCenter will send you updated materials, regulatory changes, or clarifications - so your policy templates and compliance knowledge remain current.

Leave Management laws include FMLA, ADA, COBRA, Workers' Comp, and more.